Personal & Business Bankruptcy

Compassionate Counsel In Your Time Of Financial Need

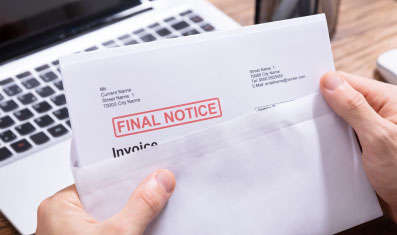

Are you overwhelmed with debt? Does the threat of losing your home or car keep you awake at night? Do you wish the barrage of harassing phone calls from creditors and debt collectors would stop?

You’re not alone! And you can stop the harassing phone calls and get out of personal or business debt.

Everyone’s story is different but the result is the same: you’re worried about foreclosure, you’re burdened with debt and interest rates that seem determined to keep you there, and you dread answering the phone. The good news is that you’ve already taken the first step to regaining control of your financial life just by being here.

Whether you are an individual or a business owner who has become overwhelmed with debt, filing for bankruptcy may be your best option. But even as bankruptcy laws are designed to help individuals and businesses put the financial pieces back together again, they can be complex and overwhelming to navigate, especially during times of stress.

At the Law Office of Mikita & Roccanova we understand the stress and fear that comes with overwhelming debt. We also have the experience and knowledge to walk you step by step through the legal system to find the best relief for your situation.

We will evaluate your circumstances and educate you on your options so that you can make informed, confident decisions about your financial future. We explain the process to you so that you are comfortable and confident knowing that your needs are being met and we provide a confidential, safe and nurturing environment where you can begin to feel the pressure ease.

Chapter 7 Bankruptcy

Typically considered the simplest and fastest form of bankruptcy, Chapter 7 relief is available to businesses and individuals who qualify by meeting certain income and equity requirements. In most qualifying cases, your debt will be completely forgiven without loss of anything you own. However, there are some types of debt that won’t be affected, such as alimony or student loans, so when we meet with you we will evaluate your personal situation to determine whether this is the best option to help you close the chapter on debt.

Chapter 11 Bankruptcy

This type of bankruptcy protection is often filed when you have significant income but need more time to reorganize and pay off debts. It is also commonly used for protection under a business partnership or corporation to help you keep your business alive while paying creditors over time. We’ll discuss your specific needs to determine the best course of action for you.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is typically best for those with enough income to repay debt within three to five years. It will also save your home from foreclosure and eliminate second mortgages when possible. If your income is too high to qualify for Chapter 7, then this may be a viable option. Let us work with you to determine your needs and qualifications so that you understand your rights and responsibilities and can take control of your finances again.

Save your car, home or business. Stop the harassing phone calls and avoid the lawsuits. Contact us for a free consultation and let’s talk about your fresh start.

We are a Debt Relief Agency helping people file for bankruptcy relief under the Bankruptcy Code.