In this three-part series, we’re answering some common questions about bankruptcy, including what debt is (and isn’t) affected, what to expect from the process, and finally, how bankruptcy affects your future.

It’s understandable to have concerns about your ability to recover financially after such a significant step, but it helps to be prepared so you’ll understand the risks and be armed with the knowledge you need to make the most of your fresh start.

Can I get a credit card again after filing bankruptcy?

The simple answer is: yes. But as with most things in life, the reality is not as simple.

After your debt is discharged, you may be surprised by an influx of credit card offers targeted specifically toward people who have recently filed for bankruptcy. And while you may be approved for such a card, it is likely to have a low limit and high interest rate, so proceed with caution.

If you have a budget outlined and use your card carefully, paying off your balance each month, this can actually help you rebuild your credit. But getting into trouble on a high-interest card after a bankruptcy won’t do you any favors.

Some lenders have cards that are designed for people who have filed bankruptcy, too. These are typically secured cards, which means you’ll be required to put down money to secure the debt, say a few hundred dollars, which then becomes your credit limit. This is a low-risk way of using a credit card and rebuilding your credit at the same time.

[divider line_type=”No Line” custom_height=”20″][button color=”accent-color” hover_text_color_override=”#fff” size=”large” url=”https://www.mr-laws.com/contact-us/” text=”Have questions about bankruptcy? Contact us for a free consultation.” color_override=”” image=”fa-comments-o”][divider line_type=”No Line” custom_height=”20″]

How long does bankruptcy stay on my record?

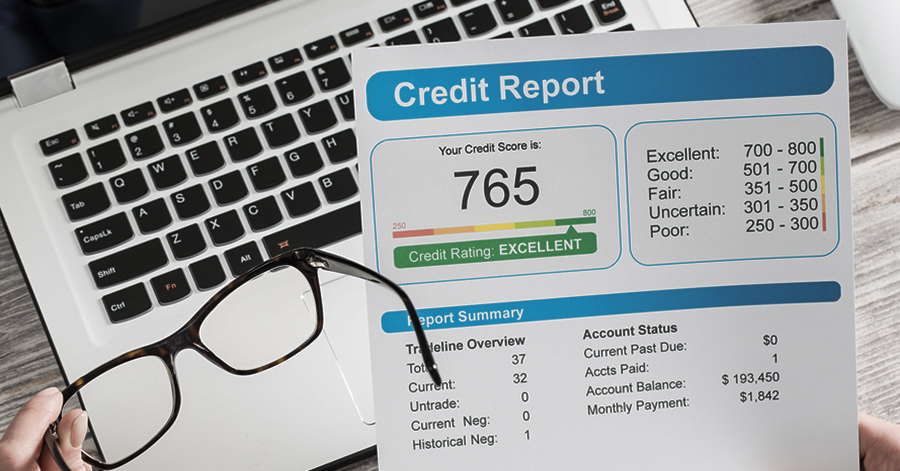

Chapter 7 stays on your credit report for ten years. A Chapter 13 will stay on your credit report for seven years.

That doesn’t mean, however, that you will have a low credit score for the duration of that time. While you shouldn’t expect a high score following a bankruptcy, you can bring your credit score up to 700 within four to five years if you rebuild wisely.

How do I rebuild my credit score after bankruptcy?

After your bankruptcy case is closed, it’s a good idea to check your credit report for accuracy. You can request a free copy from each of the three reporting bureaus each year. If you find errors, correct them with the bureaus immediately.

One of the best things you can do to rebuild quickly is to carefully manage any secured or unsecured credit cards. If you do apply for new cards, be sure that they are from organizations that report to the credit bureaus or they will not affect your score. Use your cards to charge strategically – that means charging no more than 25% of your credit limit, and be sure to make all payments in full and on time.

You can also apply for a gas credit card or retail credit card, which typically have less stringent application processes. Again, use these wisely. At this point, charging is all about rebuilding your score, not about deferring debt.

[divider line_type=”No Line” custom_height=”20″][button color=”accent-color” hover_text_color_override=”#fff” size=”large” url=”https://www.mr-laws.com/contact-us/” text=”If you’re struggling financially, contact us to find out what bankruptcy options can work for you.” color_override=”” image=”fa-comments-o”][divider line_type=”No Line” custom_height=”20″]

Will I lose my job if I file bankruptcy?

The law prohibits government agencies and private employers from discriminating against you for filing bankruptcy. That means you cannot be terminated solely based on your bankruptcy or inability to pay a debt that was discharged. It also means that if you were looking forward to a promotion, you cannot be denied the promotion based solely on the bankruptcy. Nor can your salary be reduced or your position be demoted.

The key word in that description is “solely” and opens up the door for employers to find another reason to terminate you. Unfortunately, it can be difficult to prove motive in such a case or to definitively show that you were fired solely because of the bankruptcy.

You may choose to opt for openness with your employer, rather than having him or her discover your bankruptcy through other means. If you can easily explain your situation to an understanding employer, honesty may head off a clash down the line.

The reality, however, is that most employers will have no reason to learn about your bankruptcy unless you have filed a Chapter 13 and repayments are being deducted from your paycheck, or you have listed your employer in your petition as a creditor.

Your employer may learn of your bankruptcy by searching public records or conducting a background check, but you are not required to disclose your bankruptcy to your employer, so whether you choose to do so is up to you.

If you find that you are the only person in the company being fired, or if the firing happens immediately following a bankruptcy and you suspect that you’ve been discriminated against, contact your attorney for guidance.

There is one notable exception, which is that if you are bonded in the financial industry (as a broker-dealer or investment advisor), you are required to report your bankruptcy to your employer and may be terminated, since your job requires that you are trusted with people’s money. You will still have the ability to explain your bankruptcy, however.

What if I need to look for another job?

Unfortunately, there is no law that protects you from being denied a job with a private employer based on a bankruptcy. Some employers conduct a background check that includes a credit report review, and they are within their rights to deny employment because of a bankruptcy.

If you are concerned that a bankruptcy may come back to haunt you during a job application, you may choose to be up front about it and speak with your potential employer about your past challenges and what you have done to overcome them. Open communication may outweigh the negative connotations of seeing the bankruptcy on your credit report.

On the other hand, a government agency may not refuse to hire you based solely on a bankruptcy.

Bankruptcy may be a good option for you if you’re overwhelmed by debt but it’s not without its risks. You can navigate those risks and better understand your options if you consult with an experienced attorney, so contact us for a free consultation. We’re available to answer your questions and help you choose the path that’s right for your situation.